In the middle of 1978, gold blew through its $200 oz resistance level for the final time never looking back.

Following this price pullback, once gold blows by $2,000 oz again, it looks to us like it won't ever return.

The fiat Federal Reserve note pile explosion in 2020 alone, pretty much guarantees that we are headed into a gold price mania phase later this decade.

US financial history has precedent for this exponentially higher gold silver price forecast targets based on outstanding M0123 piles.

As American friends and family gather around their Thanksgiving tables or devices to communicate with those loved ones they couldn’t spend this holiday with, let us take a moment, of collective gratitude for the blessings we have in our lives.

After all, there are millions of our fellow countrywomen and men who may not have much to put on their tables, nor share these holiday moments with in person or from afar.

If you are blessed to have loved ones in your life, give thanks.

On a lighter note, and as we strongly suggested, the price-pullback holidays came early this week.

Gold Price Finale Below $2,000 oz

For silver and especially gold bulls out there looking to add to positions, now is the time to be active as price weakness begets lower price bullion buying for long term wealth preservation and accumulation.

To start this week, we would like to put this gold spot price market into its full fiat Federal Reserve note regime context.

Here is gold over the last 5 decades, having reached an all-time price high only a few months ago in early August 2020, has since been pulling back and consolidating for the next major move higher.

This similar long-term gold price history chart was issued this week by Michael Oliver of Momentum Structural Analysis.

It is a reminder from a technical commodity trader who has been trading gold futures contracts ever since the COMEX began in gold derivatives in 1975 (see this US Treasury cable on the original plan hatched in London to use the COMEX futures market to help inject price volatility in order to tame demand stemming from the late 1974 escalating gold price).

Gold in its 1970s bull market to its early 1980 valuation blowoff, fought through its old price high and resistance right around $200 oz.

Once gold then cleared $200 again it never looked back.

Gold Price Blastoff 1975 - 1979

We could very well make an analogous case that this may indeed be the last shrinking timeframe in which will be able to buy gold bullion below two thousand fiat Federal Reserve notes per troy ounce.

By the middle of this decade, the gold price could be multiples higher from where it stands now.

On this channel this year we have shown viewers various long-term gold price targets using past historic US financial president versus the ongoing monetary base.

The explosions in the fiat Federal Reserve note M0123 piles this year have been exponential in size. And they have quite likely only paused for the time being.

This bar chart below made the rounds this week on financial Twitter. It shows more than one in five of all fiat Fed notes have come into existence in this year 2020 alone.

$1 in 5 fiat USD Outstanding Were Created this Year

Now with a dovish former Federal Reserve chairwoman now chosen to take over the US Treasury, the currency creation should continue ramping at a rapid pace in the years upcoming.

And even with nominal record high levels for many US stock indexes, the financial powers are already laying the verbal groundwork to buy ETFs and stocks during the next equity market crash.

As we in the west continue to further fiat financialize our economy, mostly favoring and enriching the top 0.1% of our US Treasury looting financial oligarchy.

Our supposed enemies to the east have already hedged their nation’s reserves by steadily and transparently stacking cheaper priced gold bullion over the last decade and a half.

Now their sovereign wealth fund and gold mining industry are set to become perhaps the largest players in the precious metals markets this decade unfolding.

Americans who want to protect their purchasing power in the coming years are going to be throwing more than a party a few billion fiat Fed Notes to buy our nation’s sovereign silver and gold bullion coins.

It is quite likely both the all-time Gold coin and then Silver Eagle coin annual nominal fiat sales totals, will both get broken before silver and gold have gone exponential in valuation gains.

Precious Metals' Simultaneous Peak Repeat a la 1980?

My contention on this channel has long been before this precious metals bull market has ended, we will all four major precious metals find all new nominal price highs in concert akin to the early 1980 bullion bull market peaks.

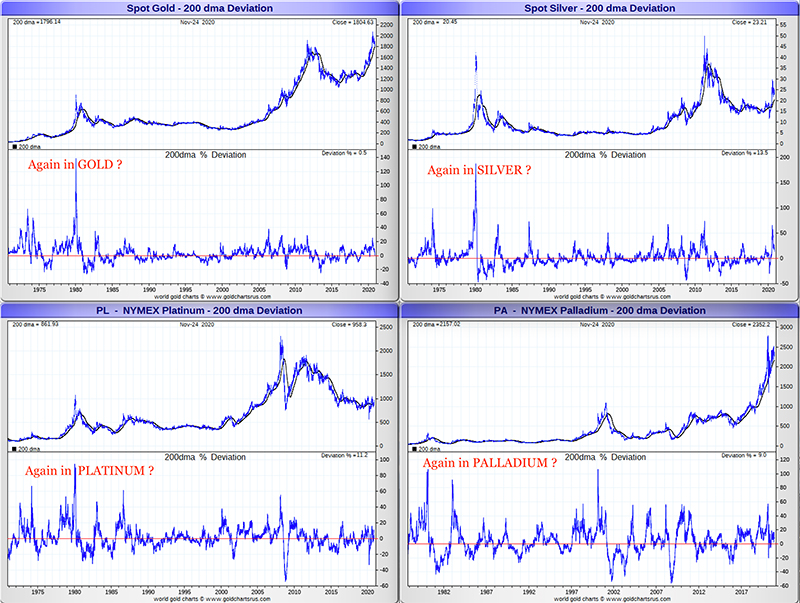

Price separations from the 200 day moving averages in all four precious metals confirms for me that we have well more to see before this bullion bull market gets manic.

See the gold, silver, platinum, and palladium 200-day moving average spikes throughout this full fiat era. Imagine what these four charts will look like when again they outrun their 200-day moving averages to the upside as they did in early 1980.

Gold, Silver, Platinum, Palladium: 200-day Moving Avg

Take advantage of these current spot price dips now.

Come this time next year there is no telling how much fiat Fed note currency creation will have to be added to keep this economic and fiat financial system from fraying or falling further apart.