Customers will often ask if their bullion transactions will be reported to the IRS or other government agency. Under federal law dealers in precious metals must report certain transactions on a Form 8300 and certain purchase orders through a Form 1099-B. The guidelines that require bullion dealers to report certain transactions are based on The Bank Secrecy Act of 1970, and 2001 Patriot Act.

These reporting requirements were established to provide agencies with necessary information to combat the illegal activities of money laundering, drug trafficking, tax evasion, and terrorist financing. A filed Form 8300 or Form 1099-B is not an accusation of illegal activity but a federal requirement of bullion dealers. However, failure to comply with these requirements or intentionally avoiding reporting requirements is illegal and could be punishable by fines, criminal charges, and imprisonment.

IRS Form 8300

Simply put an 8300 is required to be filed by SD Bullion when cash or cash equivalent payment of $10,000 or more is made. This applies to all payments received within a 24 hr period or for related transactions. While SD Bullion does not accept direct cash payments in any amount, we do accept some cash equivalent payment types. The IRS defines cash equivalents as: cashier's checks, bank drafts, traveler's checks, and money orders with a face value of $10,000 or less.

Please see our payment and pricing page for more detailed information on the payment methods we accept. For more information on the Form 8300 please consult a tax professional or review the IRS website.

IRS Form 1099-B

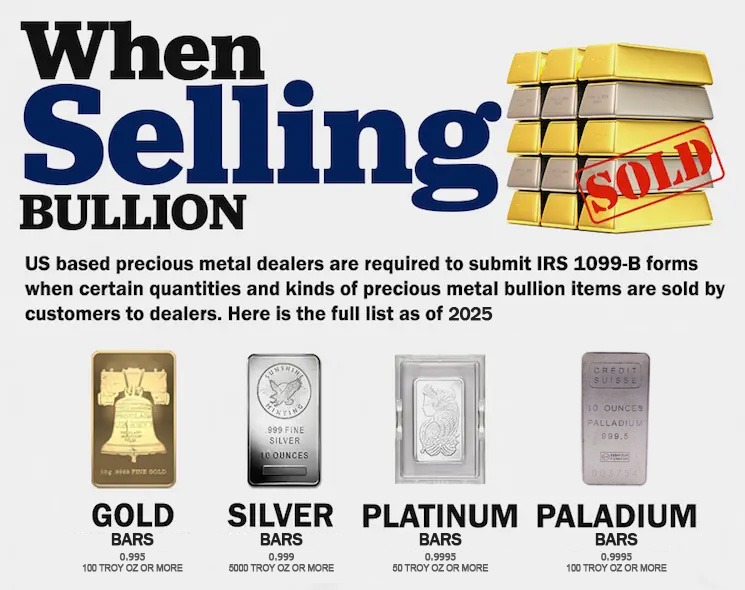

A bullion dealer may need to file Form 1099-B if they engage in certain transactions involving the sale of precious metals like gold, silver, platinum, or palladium. Specifically, the dealer must file the form if the sale of the bullion or other precious metals meets certain criteria.

| REPORTED IRS BULLION ITEMs SOLD (customers selling to US based bullion dealers) |

MINIMUM FINENESS | MINIMUM BULLION IRS REPORTABLE AMOUNTs (not structured) |

| Gold bars |

0.995 | Sales of 100 ounces of gold in not less than one (1) 100 ounce bar or three (3) one-kilo bars (32.15 ounces each) |

| Silver bars | 0.999 | Sales of 5,000 ounces of silver in not less than five (5) 1,000 ounce bars |

| Platinum bars | 0.9995 | Sales of 50 ounces of platinum in bar sizes of 10 ounces or larger |

| Palladium bars | 0.9995 | Sales of 100 ounces of palladium in bar sizes of 10 ounces or larger |

Capital Gains Tax

Selling precious metals may lead to generating reportable income and could be subject to capital gains tax; even if that transaction was not required to be reported by the bullion dealer. Please be sure to consult a tax professional for guidance on any bullion sales.