What an interesting year in the markets, and what an interesting end to the year!

Right now, to end the year, the big news is that Economic Impact Payments have already begun to be deposited in eligible US taxpayers’ bank accounts.

From Treasury Secretary Steve Mnuchin:

Deposited "as early as tonight"?

That’s December 29th, for those keeping score, so it looks like I got that call right in that we would ultimately get two Economic Impact Payments in 2020!

Not to brag of course, because there is no such thing as skill mixed with dumb luck, but rather, to make a very, very important point: The Federal Reserve Note, commonly called the “US Dollar”, is unbacked, debt-based fiat currency dependent on unsustainable, exponential growth.

As such, the path of least resistance, which is a mathematical certainty anyway, is hyperinflation, so the question becomes, two stimulus checks were doled out in 2020, but how many will be doled out in 2021?

Regardless, round two of the stimulus checks are being doled out right now:

And notice the convenient status checker!

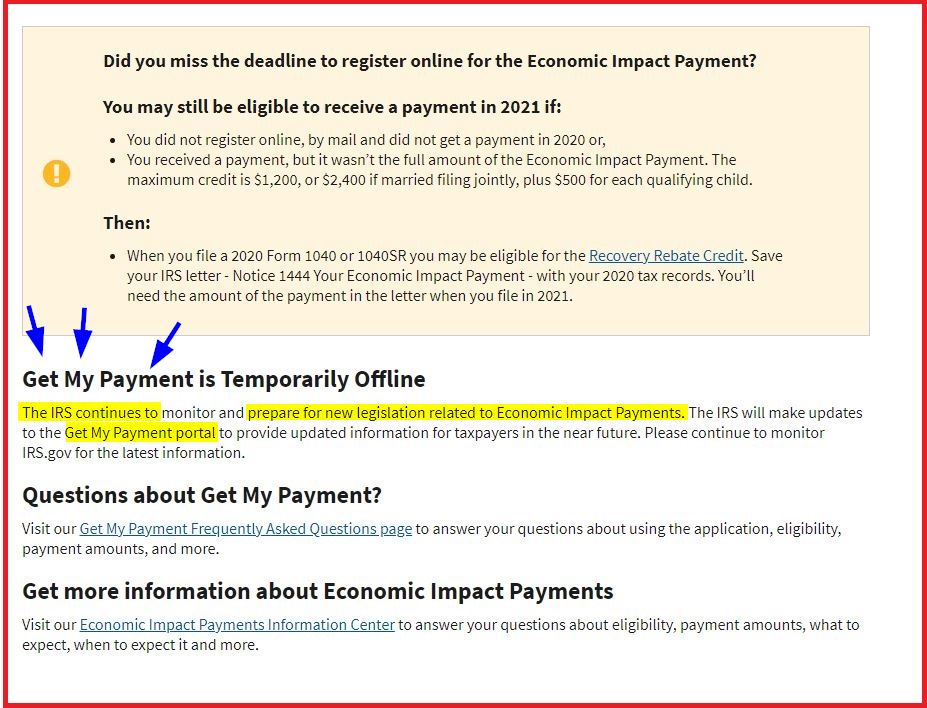

There's only one problem with checking the status, however:

The status checker doesn't really work right now, but notice what is not said, but rather, what can be used to understand that hyperinflation is indeed the path of least resistance: The "Get My Payment portal".

In other words, there is a "portal" being set up for people to "get their payments", and not only that, but Mnuchin, by way of his link to the IRS, is basically informing us that the IRS is preparing for "new legislation" regarding Economic Impact Payments and that new "updates" are coming to the portal, so these are little dots that can be connected to give us a picture of the ramping up of fiscal spending, not the winding down of it.

Silver has somewhat ramped up into the end of the year:

Silver opened the year at 17.90, and anybody who has been "dollar cost averaging" over the last, call it, six years or so, is now beginning to see the benefits of investing in silver.

Pro Tip: Anybody on the receiving end of the Economic Impact Payments who is willing and able to save that “money”, may want to consider either gold bars, or silver coins, or both, because quite frankly, regardless of what the Fed or the Bureau of Labor Statistics claims, consumer price inflation is all around us, and increasingly so, and so saving that newfound money for even six months, in my opinion, may result in drastically reduced purchasing power.

And hedonics works in reverse, so the nice refrigerators, or the nice computers, or the nice washing machines, or the nice shoes & apparel, or the nice furniture, or the nice whatever, will simply not be available, and what will be available will be of much higher cost and substantially lower quality.

This reduced purchasing power is further aggravated by the global supply chain disruptions we've basically seen all year long, which not only persist to this very day but seemingly, will persist for quite a while.

Therefore, if the question is, “what should I do with my Economic Impact Payment?”.

Well now, the Silver Bugs, Stackers, and other Smart Investors are on to something, aren’t they?

Smart people still have the chance to be on to something that can result in free gold at the end of the cycle:

Of course, if a person was able to convert anywhere near 1 single ounce of gold for over 125 ounces of silver, one only needs the ratio to move from where it is now to 62.5 to score that free ounce of gold!

In my opinion, however, the ratio will still fall much, much further, so those people taking advantage of the gold to silver ratio arbitrage who entered at such extremes may want to hold off until the ratio plummets more in line with its historical average of, call it, 16 to 1.

If that is the case, or for the simplicity of the math, in purely theoretical terms, if a person sold 1 single ounce of gold for 125 ounces of silver, and if the ratio goes to 12.5, then that person could sell those 125 ounces of silver for 10 ounces of gold!

It's kind of like free money, isn't it?

It's kind of like gold is climbing a wall of worry in the short-term:

Or is that more like textbook charting in that we've got our second higher-low to go along with our first higher-high?

Either way, I still think the short-term outlook is bullish!

I've been expecting platinum to finish the year in the green:

At $1072, platinum is now up over 10%, year-to-date, but since mid-November, platinum is up almost 25%!

Palladium continues to bang around its sideways choppy channel, although it has flatlined as of late:

We could see a leg-up and a new sideways choppy channel established, but I do think the trend will be this sideways choppy channel until the other three precious metals move closer to parity.

There has been a lot of talk about "economic collapse" and "global depression" and all that bad stuff this year, but copper doesn't seem to be buying the narrative:

Since copper is up over 25% on the year, does that mean we have finally reached the point where all of the money printing matters?

Crude oil is still relatively inexpensive:

A low price for crude oil will only add fuel to the crack-up boom's fire.

No pun intended because the crack-up boom won't really be funny.

It'll be more like panicked desperation as people urgently try to convert their soon to be worthless dollars into anything of value.

But I digress.

Mainstream "market participants" are still pretty darn complacent:

Most people will learn the hard way, however, and in the case of the stock market, market participants will learn that their "money", when kept in the digital financial banking system of Wall Street instead of being deployed in the hyperinflationary crack-up boom on Main Street, may have been kept propped up by the Fed and Federal government intervention, but in the end, neither the Fed nor the Federal government can "have the market's back", and the so-called "Fed put" will be moot.

Additionally, by learning the hard way, I mean that stocks, bonds, and other paper or digital so-called "assets" may rise in price, just as the stock market keeps hitting record high after record high, but there comes a point in time when those paper assets buy nothing because there's nothing left on store shelves to buy, and that is pretty much the point in time when the dollar is outright rejected once and for all:

Until then, however, the mainstream continues its distractive, pseudo-entertaining soapboxing as to whether the stock market will benefit from the Economic Impact Payments, or whether the stock market is overvalued beyond the realm of all possibility?

It's possible the target range for yield on the 10-Year Note is 0.8% to 1.0%:

Because with consumer prices rising even faster, real interest rates are becoming even more negative.

The bottom line is that we are ending 2020 with the gift of Economic Impact Payments combined with arguably ultra-low silver prices, and this all comes at a time when the dollar is still relatively strong:

But for how long?

I hope you and yours have a safe and happy New Year!

Thanks for reading,

Paul Eberhart