Is anybody else having a grand old time trying to keep up with all of the finance news?

So many things are happening in the markets and in the economy right now that is absolutely amazing. That is to say, there are some interesting things happening on Wall Street and on Main Street that will pretty much lead to direct or indirect ramifications for everybody, and as such, as we approach the end of January 2021, now would be a good time to assess a few of the more important current events.

THE MARKETS

Suffice it to say, there is wild speculation in the financial markets that is a sight to behold. From individual stocks to certain financialized, dollar-based digital trading products, such as Bitcoin, to say there is a euphoric market mania taking place is an understatement!

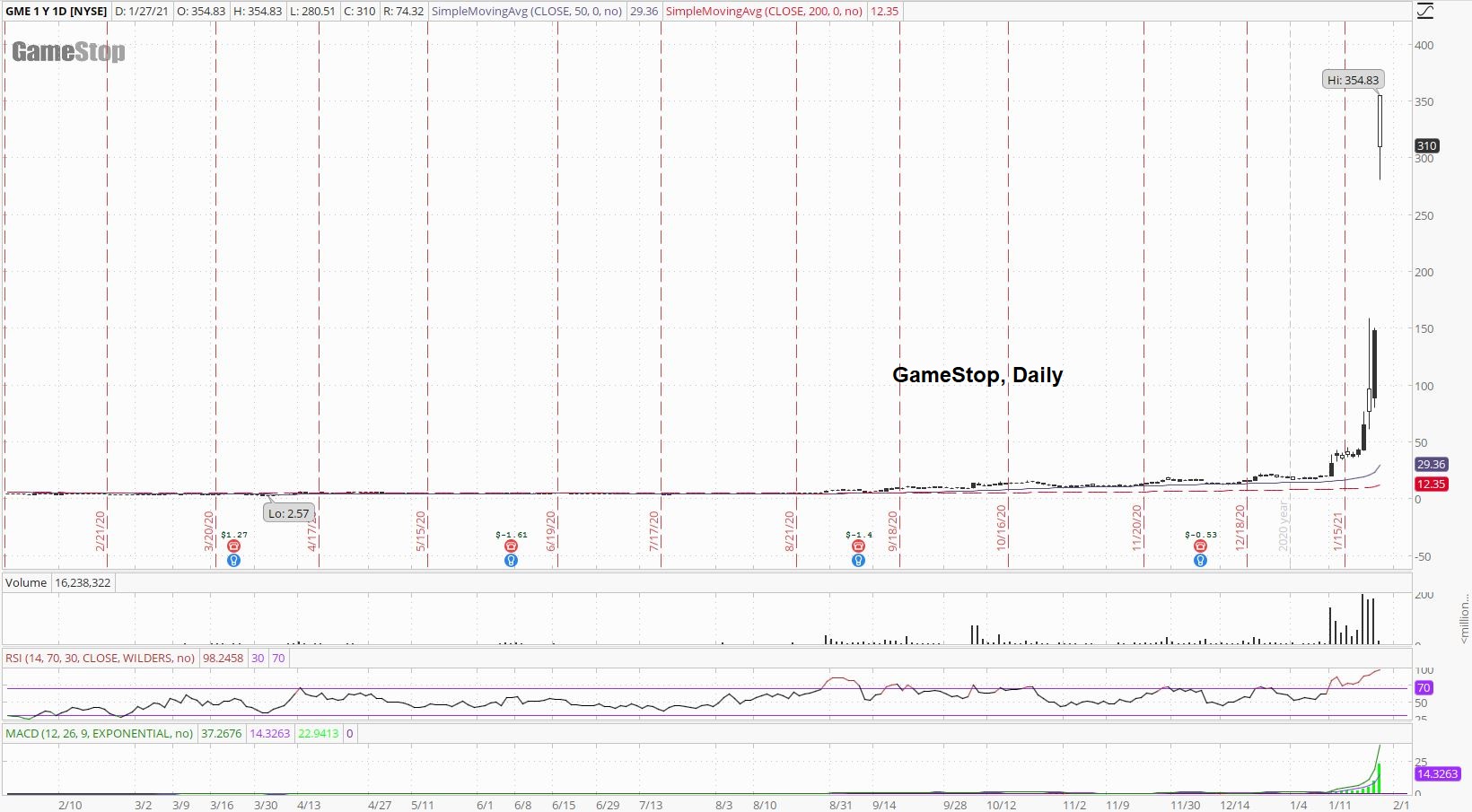

So move over Bitcoin, there’s a new head-turner in town, and its name is GameStop:

Yes, that GameStop.

As in, the company that used to sell video game consoles, video games, and video game whatnots in the malls and in the strip malls all across America, but now, well, since video game consoles are not available right now unless one is willing to go onto eBay and pay the going market rate for them, the brick-and-mortar retailer has converted its business model to selling bobblehead dolls, video game action figures, and other Chinese made toy trinkets that have somewhat of a cultish following.

For those readers interesting in the math, GameStop has gone from $5 in August of 2020 to over $350 today, which is a whopping 6,900% gain, in five months, and interestingly, or scarily, most of the "gains" have come during only the last several trading sessions alone!

Incredible!

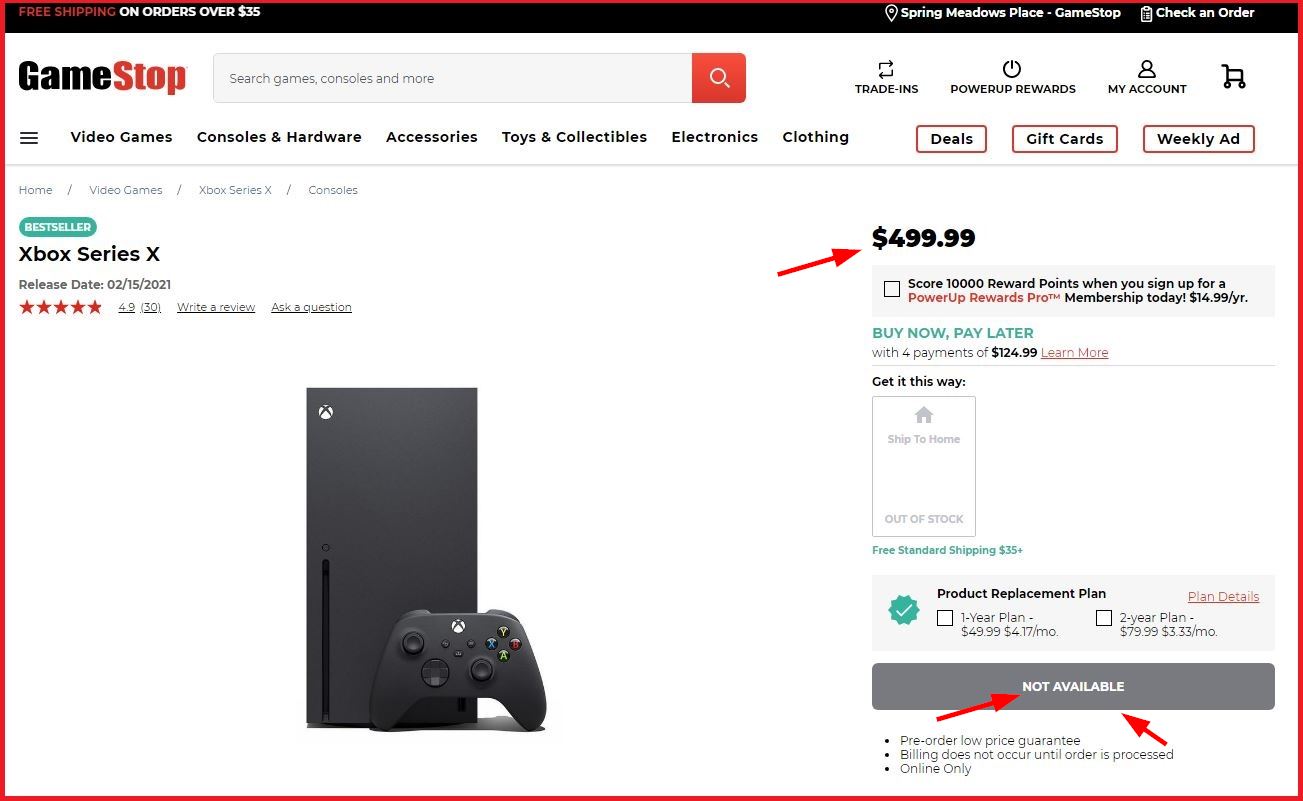

And I’m not using hyperbole when I write about the unavailability of video game consoles:

Five hundred bucks, yet nary a console.

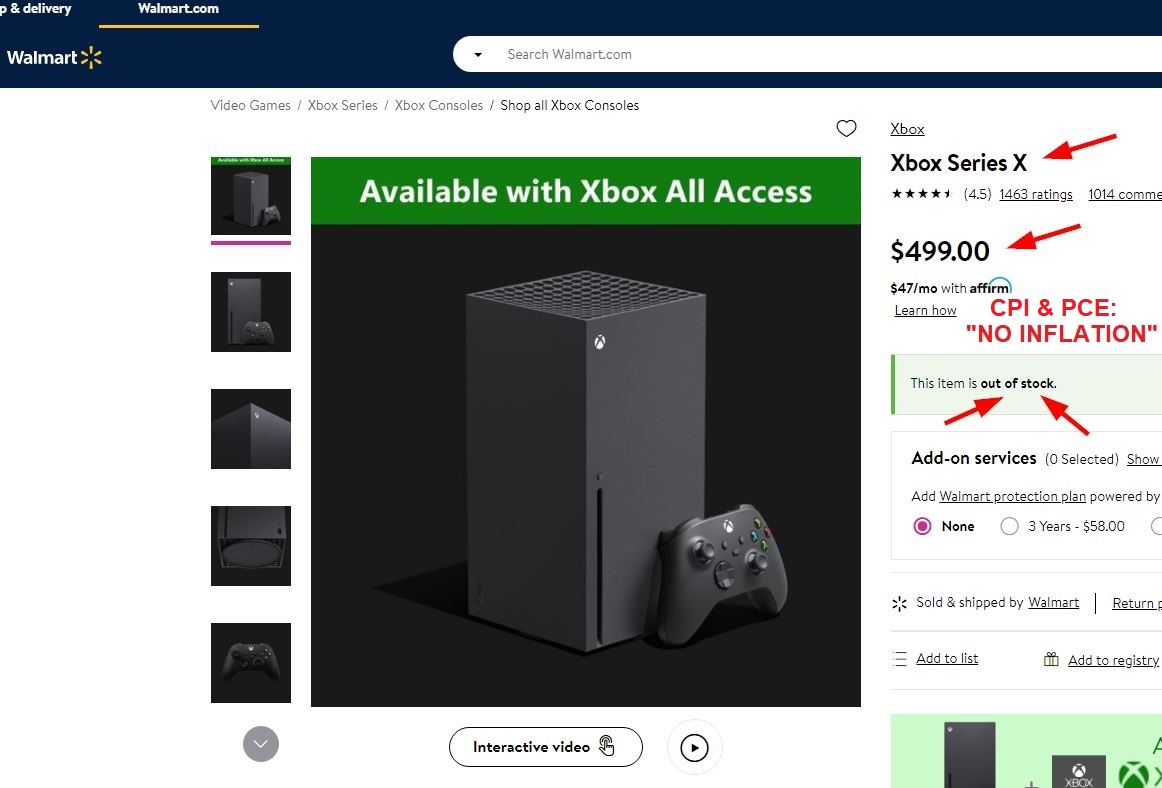

And it’s not just GameStop either, but the consoles are not available at any of the other retailers, including Walmart:

And the Fed & Federal government tell us all the time, "there is no inflation!".

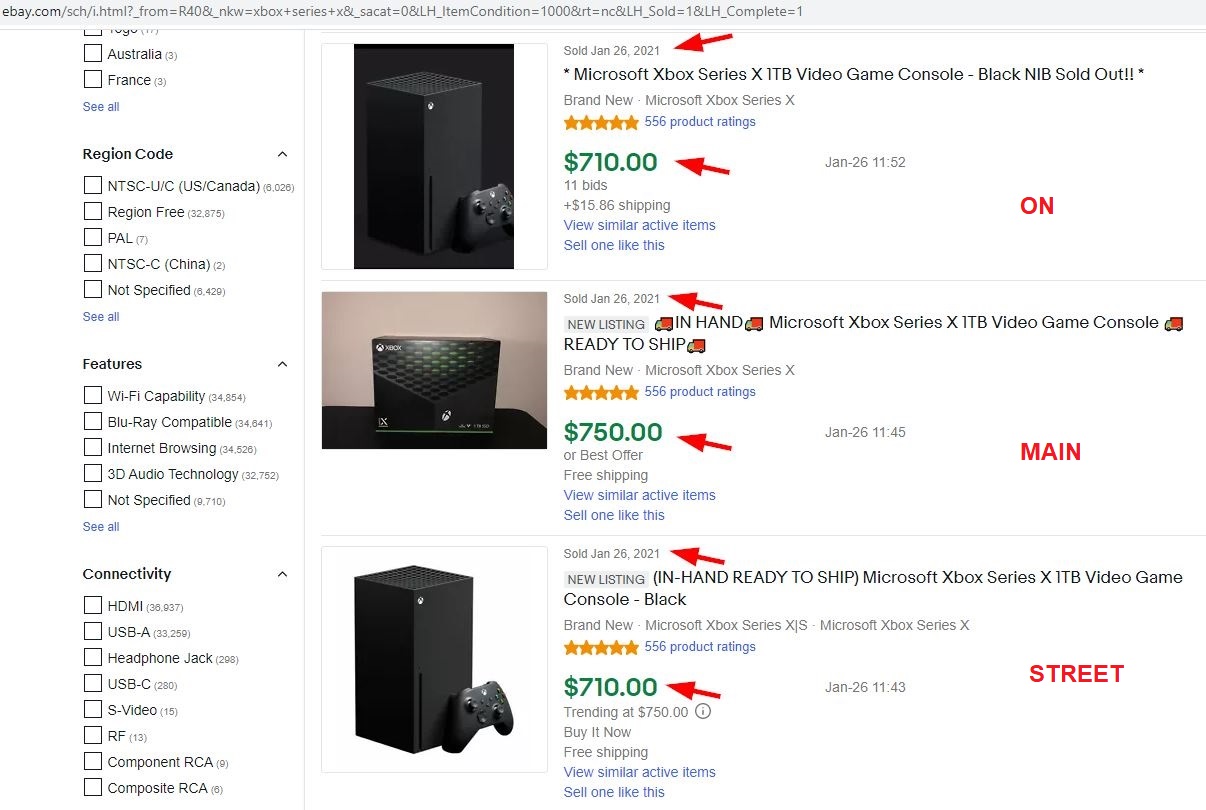

Of course, all one has to do is look at eBay to see the Xbox is readily available:

But only at a much higher price than what most people expect to pay.

Now, where have we seen that before?

Isn’t this kind of like the difference between the price you see on the screen for something versus the price you actually have to pay to get that thing into your hand?

The Fed’s FOMC Meeting and Presser

Today concludes the most recent two-day Fed meeting when the FOMC decides what to do with interest rates, when Fed Chair Jerome Powell holds a press conference at 2:30 p.m. EST, and when generally, the entire mainstream media and entire financial social media, including many people in the so-called “alternative media”, parse every word in the Fed’s Statement and search for meaning in every answer Powell gives to the mainstream reporter's whiffle ball questions.

I'd say "softball" questions, but I don't want to offend any Softball Players out there.

And really, I should say "T-Ball questions", although there's not really a pitcher needed for that.

But I digress.

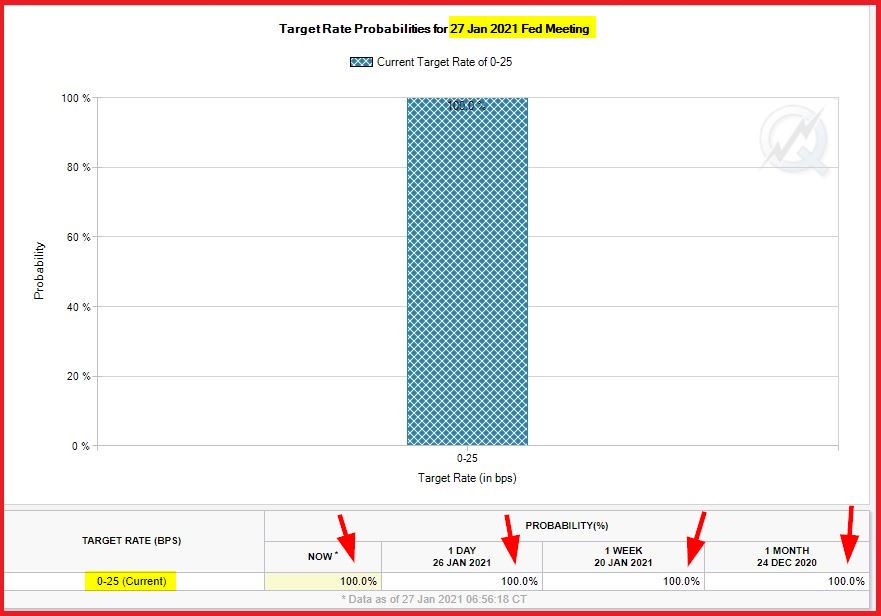

There has only been absolute certainty on interest rate probabilities for quite a long time:

So the real question is, with the latest round of Federal fiscal stimulus, the Biden Administration’s first round of stimulus, taking a backseat to other matters that Congress is currently spending its time on, is the Fed dovish enough for the markets right now?

Of course, many analysts will declare today’s FOMC meeting in general, and the press conference specifically, to be one of the most important ever, because of all the things happening in the markets, such as the euphoria described above, as well as the US Treasury Department moving right along with Janet Yellen now at the helm.

In other words, I think there will be much talk during Jerome Powell’s press conference about what he and Yellen will be working on, together, moving forward.

On that note: In 2017, Janet Yellen, the former Fed Chair turned current US Treasury Secretary, said that she didn’t believe there would ever be another financial crisis in our lifetimes, and yet, just yesterday, in her day one letter to staff, the 84,000 Treasury Department employees, Yellen said that the current crisis may even be bigger than the 2008 financial crisis, and Yellen also said this economic crisis has been building for 40 years!

MONEY VELOCITY AND THE SENSE OF SPEED AND URGENCY

During a press conference this week, Biden’s Press Secretary was asked about the upcoming $20 Harriet Tubman Federal Reserve Note, commonly called “the twenty-dollar bill”, replacing the current $20 Andrew Jackson, and Press Secretary Jen Psaki said the administration is “exploring ways to speed up” the new $20 bills replacing the current $20 bills. In my opinion, this is a very interesting, subtle development that not many people are discussing anywhere in the mainstream media or in the alternative media.

For example, some food for thought:

- Will the old $20 bills have a “spend-by” date before they are deemed no longer “legal tender”?

- Will investor psychology and dollar-user psychology change with a new $20 bill, when nobody alive today has ever known any other $20 bill, and when dollar coins never really caught on, meaning, will holders and users of US dollars feel that the new $20 bills have less “value”?

- Will there be spillover into other Federal Reserve Notes too, and will this cause “mattress money” to suddenly come out into the mainstream and wipe out the already less than half full shelves at Walmart?

You see, in my opinion, the news of changing the $20 bill may appear to be a formality on the surface, but under the surface, and more importantly, on Main Street, there could be unforeseen consequences that further contribute to the hyperinflation of the US dollar itself.

Said differently, and I’ll ask it as a question: Why is it that even though it costs more than a penny to mint a penny, which doesn’t even have the copper content that it once had, we still mint them as opposed to doing what the Canadians did and just get rid of them altogether?

Remember: In a prior report, I argued there was the long, slow hyperinflation of the US dollar over about 100 years, of, call it, 1913 to 2010, and this hyperinflation can be thought of similarly to the way people think and say, “the US dollar has lost 97% of its purchasing power”, there was the medium-term, steady hyperinflation of the US dollar over about 10 years, of, call it, 2008 to 2019, and this hyperinflation can be thought of as the response to the Great Financial Crisis of 2008, and now, in my opinion, beginning in 2020, or beginning now, in 2021, we’re approaching, if we have not started already, the quick, parabolic hyperinflation of the US dollar, which will not take many years to run its course, but rather, if staying true to the rhythm and the patterns we've seen thus far, will take about a year before the US dollar reaches its intrinsic value of near zero.

That's right.

The intrinsic value is not "zero" but "near zero".

And why is that?

There are infinite devaluations that can take place between one and zero, so the US dollar doesn't have to fall to absolute zero before it is worth nothing, but rather, it just has to fall to the point that the dollar is simply rejected as money once and for all.

Because cashiers will get tired of weighing piles of the dollar at checkout after they weight and ring up a couple of pounds of apples, and people will get frustrated with having to do the math of budgeting when last week ranch salad dressing cost $30 a bottle, but this week it costs $35, and so on, and so forth.

There comes a point where it is simply obvious to all, and the dollar as we know it will be no more.

I say all of this because lately, I get this feeling that there is a sense of “speed” and “urgency” when it comes to the new Administration in general, and the markets and the economy specifically. From Janet Yellen’s “act big” moment to President Biden’s executive orders on expanding food aid and speeding up the delivery of stimulus checks, and to the new $20 Tubman’s and more, I'm sensing vibes that feel like “print, print, and print” and “faster, faster, faster”.

The more the price of silver languishes around twenty-five bucks, the faster it will start really ramping to the upside once it starts rallying again:

Can anybody really argue there is a better value out there than physical silver?

I don't think so, but that's not so say I don't think gold is a not great value right now:

However, if the scary-scary "death cross" plays out on the chart and we see even more value in the form of a falling paper price of gold, that's music to a stacker's ears!

Remember a couple of years ago when so-called "legendary investors" said, "buy gold at any price"?

Yeah, well, check out where the price is now compared to recent all time highs!

If you thought this was Groundhog Day you would be close:

Anybody else looking forward to the excitement again?

Follow up question: If we have been looking forward to some more excitement since last August 2020, do we really have much longer to wait?

Lately, palladium has been riding the resistance line of its sideways choppy channel, which now also pretty much coincides with palladium's 50-Day Moving Average:

Nothing has really changed, and we're still marking time, however, I'd like to see a quick drop down to the support of the channel and a powerful upswing to punch through that overhead resistance once and for all!

That said, I still don't think it happens until the other metals catch-up, and that continues to be the correct call.

Platinum is pretty much "unch", year-to-date:

Does that mean platinum will catch-down to gold & silver's disappointing start to the year and turn red, year-to-date, or, alternatively, does that mean gold & silver are sort of mispriced right now?

In my opinion, it's the latter, and any weakness in precious metals here is a gift, as well as a bear trap.

Yeah, I'm biased like that, but we are printing up funny money like there's no tomorrow, so there's that!

That barometer of the economy still says that inflation is here:

Right now, copper is letting that fact sink in.

Crude oil is doing the same:

On the surface, it seems like the Biden Administration is not friendly to "big oil", so superficially, I'm expecting a rising price of crude oil to leave the low $50s behind us pretty quickly.

It still records high after record high in the stock market:

Have we even had our melt-up, blow-off top yet?

Will we?

Or will the stock market just keep chugging along?

It's been a long time since we've seen some real fear in the markets:

All things considered, of course.

The Fed may have considered "Yield Curve Control" as a new tool they'll unveil today:

But no matter what they call it, it will just be a fancy way of saying, "we'll continue to suppress interest rates, intervene in all markets, and force our own version of what we deem to be price discovery".

Again, I wouldn't get too excited about a bounce in the US dollar:

Because all signs point to speeding up its decline, not accelerating its ascent!

Thanks for reading,

Paul Eberhart