Gold Bar Size Comparison Chart: Pros, Cons, and Investment Insights

|

Bar Size |

Use Case |

Pros |

Cons |

Liquidity |

Premium per Gram/Oz |

Physical Safety Needs |

|

1g – 10g |

Gifting, short-term, and barter. |

Extremely liquid, ideal for small and quick trades. |

High premium, easily lost individually due to size. |

Very High |

Very High |

Low: easily hidden, portable. |

|

20g – 50g |

Entry-level investing and savings. |

Still liquid (especially in the 1 oz size), compact, and offering a more efficient value per space. |

Premium is still high relative to larger bars. |

High |

High |

Low: fits in small safes or concealed areas. |

|

100g |

Medium-term investing |

Balanced in value, safety, and resale convenience. |

May require better storage due to higher value. |

Moderate |

Moderate |

Medium: can be kept in a home safe or vault. |

|

250g – 500g |

Long-term investing |

Lower premiums and ideal for long-term storage. |

Less portable, less discreet, higher theft risk. |

Moderate to High |

Low |

High: requires a reliable home safe or a deposit box. |

|

1kg |

Wealth storage, institutional use |

Excellent for preserving significant wealth, with the lowest cost per gram. |

Not suitable for frequent transport or at-home storage without security. |

Low |

Lowest from the list |

Very High: best stored in a vault or third-party safe deposit. |

With the rising price of gold and recent geopolitical shifts, many investors are turning to gold, a typical move in uncertain times.

Gold products, such as gold coins and bars, gain popularity as demand for these items increases.

But which bar size should you choose?

In this article, we’ll explore how the right gold bar size can impact liquidity, premiums, storage, and resale value, helping you find the best option for your goals, whether you’re investing, collecting, or both.

Why Gold Bars?

It’s no secret that a diversified portfolio is one of the most popular strategies in investing. Most investors seek assets that can be easily liquidated, particularly during times of financial stress.

In this context, gold plays a crucial role; it has stood the test of time as a reliable haven, consistently gaining value during times of economic and political instability, demonstrating that when things go wrong, gold often appreciates in value.

I explored in more depth how geopolitical events influence the price of precious metals in this article here.

The spot price of gold influences the cost of the bar and can fluctuate over time, as the spot price of gold changes daily in response to market fluctuations.

Types of Gold Bars

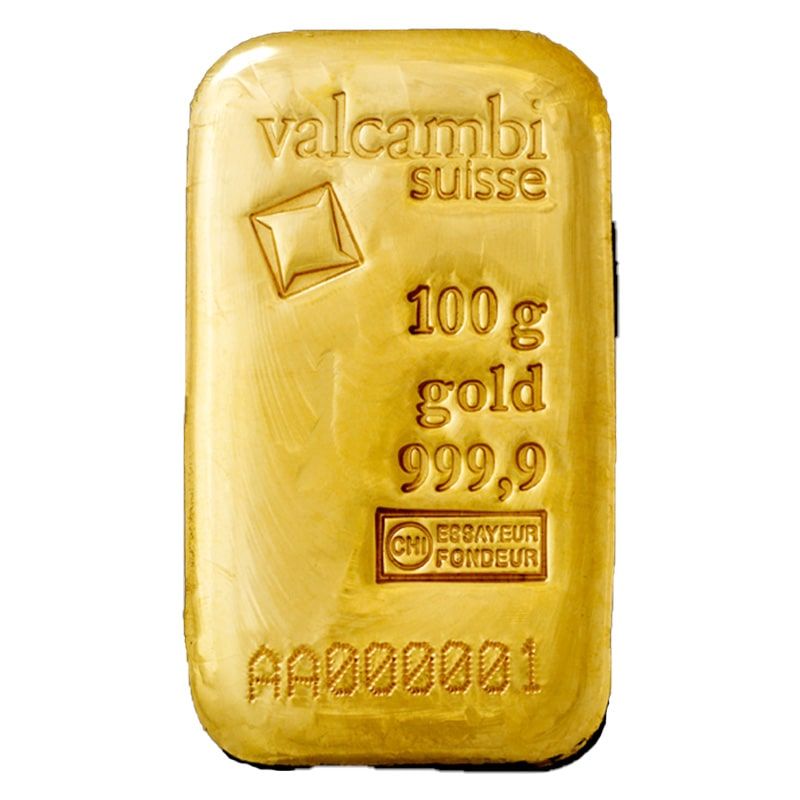

Gold Bars can have several characteristics, but they can be separated into two main categories based on their manufacturing method: cast and minted.

Cast bars, represented by the image on the left, are formed by pouring molten gold into molds, resulting in a rougher, more natural appearance. Minted bars, as shown in the picture above, are cut from pre-rolled cast bars and have a smoother, more refined, and uniform appearance.

But when it comes to investing, what are the pros and cons of each type?

Cast bars typically cost less per ounce than minted bars. Because of this, they’re often favored for long-term investment strategies.

Minted bars, on the other hand, known for their intricate designs and sharp details, tend to be more liquid and are often used for shorter-term gains, where quick resale is a priority.

The Best Gold Bar Size For Your Investment

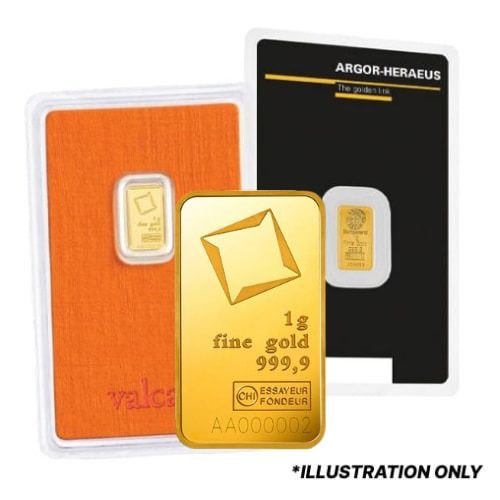

1 Gram to 10 Gram Gold Bars

The sizes, which range from 1-gram to 10-gram gold bars, differ by a few hundred dollars, but both are suitable options for beginner investors. They offer affordability, easy liquidity, and can even be helpful for bartering.

1-gram gold bars are more commonly used for gifting or as ornamental pieces rather than for investment stacking. Many people choose to wear them as pendants, combining aesthetics with symbolic value.

Additionally, all these small bars often come in an assay card, which ensures authenticity and protection from environmental factors.

However, while these smaller bars offer lower upfront costs, they typically come with a higher premium per gram compared to larger bars. This is due to the proportionally higher manufacturing and packaging costs involved in producing smaller units. As a result, while they’re ideal for gifting or starting a collection, they may not be the most cost-effective option for investors focused purely on maximizing gold value per gram.

Furthermore, gold remains an asset that tends to appreciate, meaning even small investments have the potential to grow in value.

Main Advantage: Affordable entry point

Main Disadvantage: Higher cost per gram due to premiums

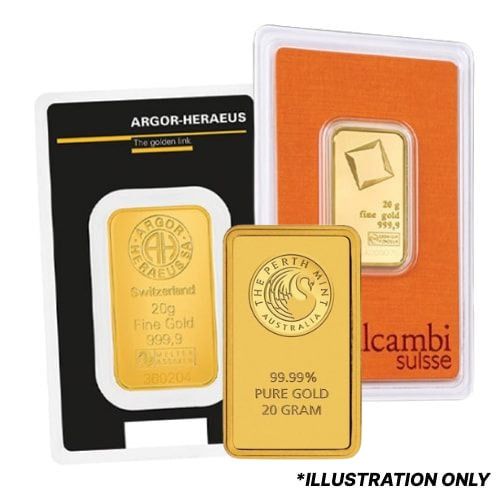

20 Gram to 100 Gram Gold Bars

Many investors still lack the confidence to commit to a full ounce (31 grams) and instead opt for the 20-gram option. The 50-gram bars are also highly liquid, much like the smaller ones, while the 100-gram bars represent a more substantial investment for those willing to take a bit more risk, but still prefer to stay within a manageable range.

These sizes remain relatively affordable, easy to store, and liquid, especially considering the ever-growing price of gold.

However, it's worth noting that premiums tend to be higher when calculated per gram.

100 gram British Gold Britannia Bar - In Assay

100 x 1 g Valcambi Gold CombiBar - In Assay

The 100 x 1g Valcambi Gold CombiBar - In Assay allows investors to purchase a 100-gram gold bar that can be broken down into smaller parts. A CombiBar is another name for this divisible bar.

Considering the current price of gold and its consistent upward trend, having several relatively small options allows investors to diversify across different products while staying within a moderate budget.

Main Advantage: Balanced mix of affordability, liquidity, and portfolio flexibility

Main Disadvantage: Higher premium per gram compared to larger bars

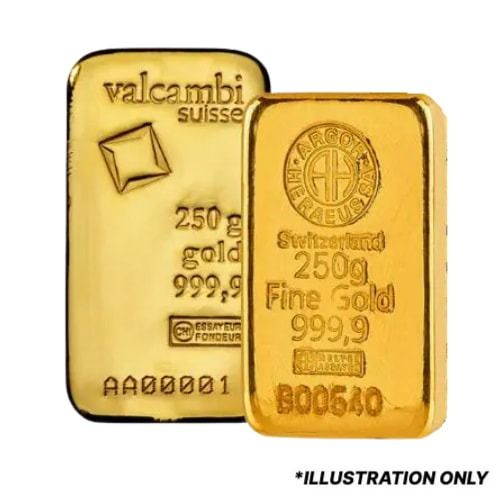

250 Gram to 1 Kilo Gold Bars

For investors feeling bold, 250-gram to 1-kilogram gold bars offer a strategic advantage, especially for those looking to pay a lower premium per gram. Unlike the smaller options, the 250g, 500g, and 1kg bars are popular among those focused on bulk investing and long-term goals.

They not only have strong appreciation potential but also serve as a secure vehicle for preserving generational wealth and personal assets. For those thinking ahead, they represent a strategic approach to wealth protection and capital growth.

The downside? These bars are heavier, do not come in sealed assay packaging, are less liquid than smaller denominations, are more difficult to transport, and require secure storage to protect against theft.

Main Advantage: Lower premiums and ideal for long-term wealth preservation

Main Disadvantage: Less liquid, harder to transport, and needs secure storage

The Most Recognized Brands

Valcambi

Founded in 1961 with the construction of a refinery in Balerna, southeastern Switzerland, Valcambi is widely recognized for its top-tier service in precious metals refining. All metals and bars are certified, carefully inspected, and individually packaged before shipment.

The 1 oz size is the most popular minted gold bar from Valcambi.

The most popular-sized cast gold bars sold are the 50-gram and 100-gram Valcambi cast gold bars. Notice how simpler and less polished they look compared to their minted counterparts.

Argor-Heraeus

Argor-Heraeus produces a complete range of cast and minted bars in gold, silver, platinum, and palladium.

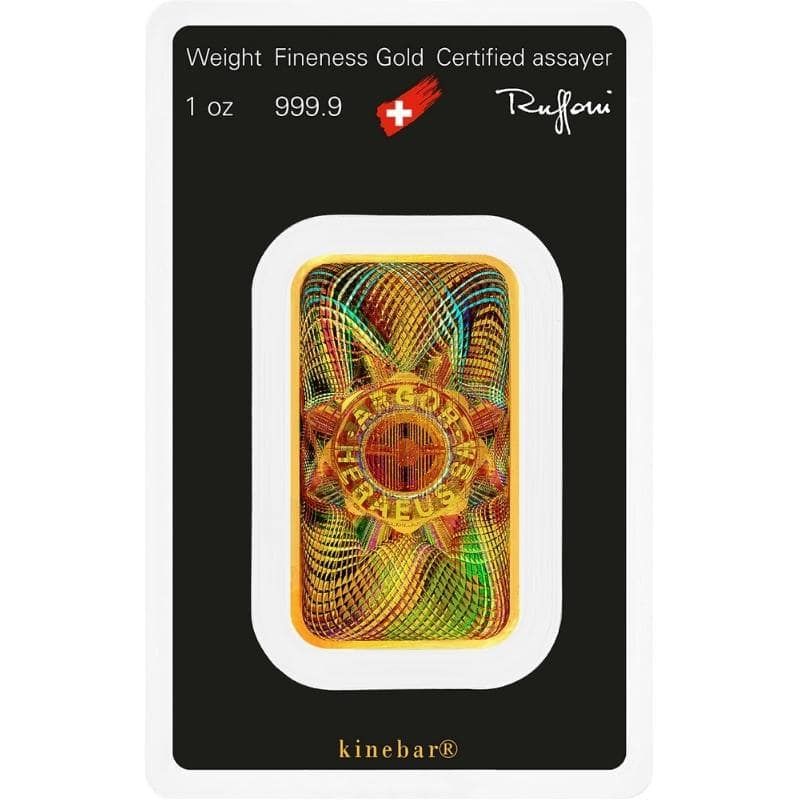

The reverse of their most famous gold bar, the 1 oz Argor Heraeus Kinebar Gold Bar features Kinebar Technology, with holographic elements embossed onto the surface substrate, including the logo engraved at its center. Different textures and colors become visible as the bar moves, creating a beautiful effect.

As one of the world’s largest precious metals refiners, it is known for its high purity standards and industrial-grade precision. Accredited by the LBMA, the company is a key supplier to international banks and bullion dealers.

Credit Suisse

Credit Suisse is a large Swiss private bank that began issuing retail-sized bullion bars in the 1980s in response to an increasing trend in investing in physical precious metals.

Credit Suisse was one of the first banks to follow this trend, beginning to issue its bullion products for its clients. Today, the brand holds a strong reputation as a globally recognized financial institution headquartered in Switzerland.

The most popular sizes, by far, are the ounce-denominated bars, which were designed to cater to the American and global markets. The name of the brand goes on the front side, together with its weight of 1 troy ounce, the content of pure gold, and the fineness level.

Perth Mint

The Perth Mint offers both cast and minted gold bars and has been active in the precious metals industry since 1899. As Australia's official bullion mint and the country's only major gold refiner, it is wholly owned by the Government of Western Australia.

The Perth Mint is renowned for its manufacture of the Australian Kangaroo and Australian Lunar Series of gold bullion coins, as well as gold coins for other countries.

The most well-known gold bar produced by the Perth Mint is the 'Kangaroo bar.' It comes sealed in a Certicard for all sizes up to 10 ounces. The front displays the bar’s purity of 9999, its weight, and the Perth Mint logo at the top, along with a unique serial number. On the reverse, you'll find a repeating design of a hopping kangaroo.

Certification and Authenticity

Some refiners will choose to produce a gold certificate with their bars; however, some LBMA-approved refiners decide not to do this, given they are subject to stringent checks as part of their membership.

Furthermore, certificates are easier to fake than gold bars themselves, so they should not be the sole proof of authenticity. For many dealers, a certificate does not affect the bar’s value.

IRA Approved Gold Bars

A Gold IRA (Individual Retirement Account) is a type of self-directed retirement account that enables investors to hold physical precious metals, such as gold coins, gold bars, and other approved forms of precious metals, as part of their retirement portfolio.

The IRS (Internal Revenue Service) permits self-directed IRA holders to invest in physical gold, silver, platinum, and palladium, provided the metals meet specific purity standards and are stored in an approved depository. This includes particular bullion coins and bars that are officially recognized and certified.

Unlike traditional IRAs, Precious Metals IRAs are considered alternative investments and must be managed through a custodian or trustee who specializes in these types of accounts.

IRA-approved gold bars must have a minimum purity of 99.5% (24-karat gold), be produced by a refiner, assayer, or manufacturer approved, and include proper markings: weight, purity, and a manufacturer’s mark. Be in assay packaging or have a verifiable serial number.

Where to buy Gold Bars?

When purchasing gold bars, it is crucial to select a reputable and established dealer.

Always make sure the dealer offers LBMA-accredited bars; brands such as PAMP Suisse, Valcambi, Credit Suisse, Argor-Heraeus, and the Perth Mint are globally respected and easier to resell.

It is essential to purchase from dealers who display live pricing based on market rates, with transparent premiums and no hidden fees. Be aware of “below the spot price” offers, as the premium you pay for a gold product also includes manufacturing, transportation, and storage costs.

Reading customer reviews on platforms like Better Business Bureau can help you assess a company's reliability and credibility. Also, be cautious of any high-pressure sales tactics or unsolicited offers, and always check for any local tax or import duties before purchasing, especially when buying internationally.

Additionally, consider whether you would like to store the bars at home or in a secure, insured vault. Reputable dealers typically offer buyback programs, which can be beneficial if you plan to resell your item in the future.

Final Words

In this article, we examined the various sizes of gold bars and their corresponding applications. Understanding the range of options available can help you identify which size best aligns with your investment goals.

Smaller bars, ranging from 1 gram to 100 grams, tend to offer greater liquidity but often come with higher premiums due to production costs. In comparison, larger bars, such as those weighing 500 grams to 1 kilogram, generally have lower premiums per ounce, making them a cost-effective choice for those focused on bulk investment and long-term wealth storage, despite offering less liquidity.

There’s no one-size-fits-all answer, as your goals shape the best choice. Still, many investors favor diversification, using smaller bars for flexibility and larger ones for long-term wealth storage.