Gold as an INVESTMENT Fundamentals

Money par excellence, a multi-millennial proven store of value, hence hoarded by governments and central banks. Adored by the east especially by over two billion Indian and Chinese. From supernovas to vaults, adornment, and high technology applications. Gold is here to stay.

For multiple millennia physical gold has helped humans insulate and insure themselves against losses of their financial wealth. During times of undervaluation, gold can simultaneously provide owners a way to greatly increase their wealth via prudent gold ownership and investment portfolio allocation.

World history and the rise and fall of civilizations have been dramatically shaped by the pursuit of gold itself. The yellow precious metal has a more than 5,000 year history in its use for adornment and a many multiple thousand year record as money or a dependable store of value.

-

-

In arguably the first example of written law (in the near 4,000 year old Code of Hammurabi), the word mĕnē is a term used to denote the weight of gold to be paid for crimes or to resolve civil conflicts. Thus a specific mĕnē of gold (or silver) is perhaps the earliest written word for money itself. In fact for most of written history, the term “money” has always meant a standard defined weight and purity of gold or silver.

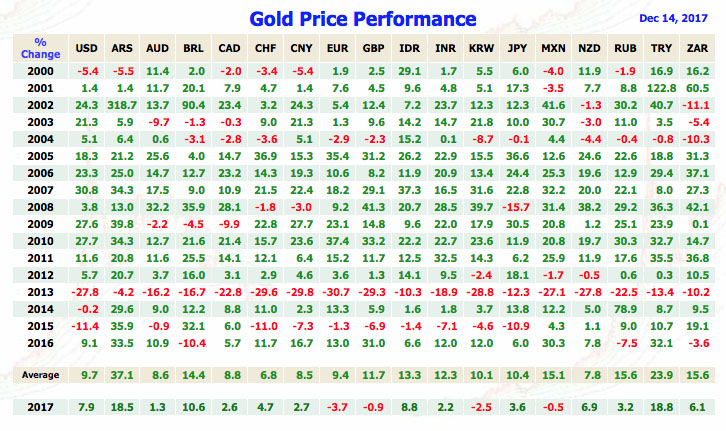

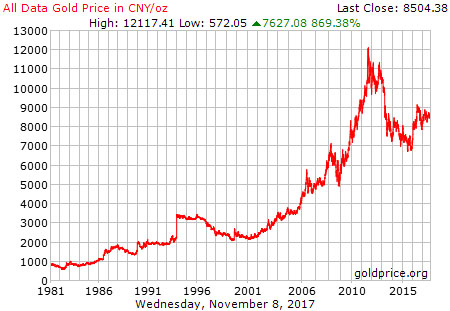

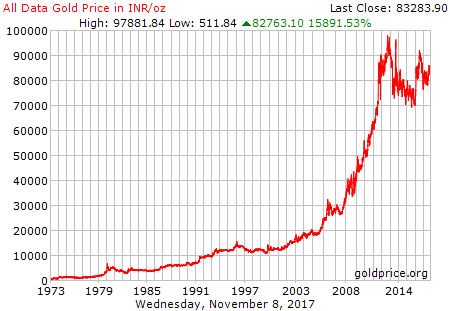

Since and following the turn of the millenium (2000 AD), the world has witnessed a pronounced increase in gold’s value priced in every single national currency issued by any government worldwide. Below is an annual scoreboard for how gold has performed vs 18 various fiat currencies issued across the world.

When you hear the term ‘Gold Rush’, you might think 19th Century gold mining frontiersmen in the western US or Canada, perhaps also in South Africa, or in western Australia.

This ongoing version is a lot different.

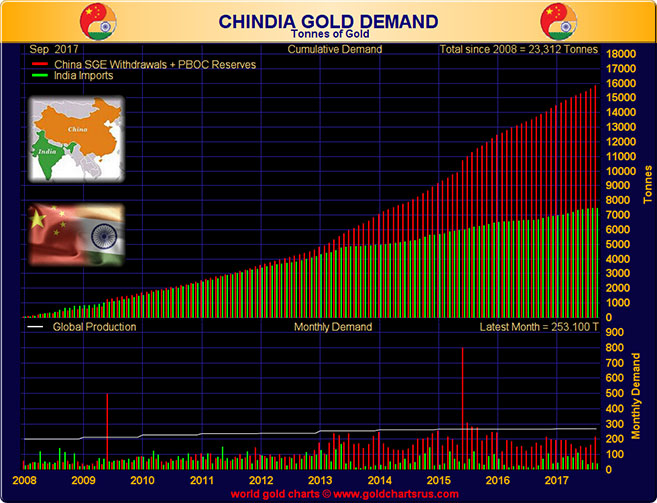

The biggest miner, buyer, and non-exporter of gold is now China.

The old ‘old west’ if you will, is perhaps now located in some of the world’s last remaining frontiers (e.g. in Africa, the jungles and mountains of South America).

We are now in the midst of the greatest gold bull market ever.

This claim is based on the sheer size of future exchange trading volumes and the sheer amounts of physical gold ounces actively mined, refined, bought, sold, and delivered (since the year 2000).

This is indeed the first, globally participated gold rush in history.

Considering current data covering ongoing government central banks and individual investor actions, the dollar amounts of gold bullion which have been purchased thus far in the 21st Century are unprecedented.

Most long term gold bullion buyers currently buy and own gold to better diversify their wealth and investment portfolios. Most gold bullion buyers understand the importance of not having all their wealth only denominated in merely 1 or 2 currencies like US dollars or euros for example.

By design all fiat currencies eventually lose their value. Their real world purchasing powers dwindle over time, thus gold bullion is often bought and owned for the long haul to help investors insulate their wealth against this fact.

In the past two centuries or so, the world’s international financial regimes and rules have changed in 30 to 40 year cycles. Over 40 years have come and gone since the fully fiat petrodollar system was established (1974). Cracks are now appearing and it is reasonable to expect the rules of the monetary system to again change sooner than later. All that is required to see this happen soon, is one more global financial crisis.

Many gold bullion buyers know this already. They are diversifying the nature of their wealth positions accordingly, preferring not to hold all their assets denominated by a single currency or lone point of potential failure.

Hence both many individual investors and especially eastern central banks are looking for asset diversification through increased long term gold bullion ownership.

Over more than the past century, varying market crashes and asset class bear markets have occurred in both western and eastern nation states in both either local or even international market economies. Recently the world has undergone an extended period of time where interest rates have been virtually zero and even negative (an unprecedented sign of rampant currency debasement).

When mathematically back-tested from the years 1968 to 2016, gold allocations could have played a much larger role in wealth preservation than most financial commentators or advisers have been, nor are even willing to suggest today.

The growth of online bullion dealers both buying and selling gold coins and gold bullion bars has increased, much in part due to the growth in internet commerce and as well as a general investor awakening from the 2008 financial crisis.

It is now quite common for investors to buy gold coins or gold bullion bars through online bullion dealers and take direct discreet delivery to door as well within insured professional non-bank bullion depository accounts.

Why buy Gold Bullion?

Directly owning physical gold bullion can offer investors:

- Wealth diversification

- Protection from both inflationary and deflationary threats

- Bank Bail-In, Bank Bailout, or general bank failure hedge

- Superior financial liquidity (easy to buy and sell)

- A potentially undervalued asset class (compared to current valuations of equities, real estate, properties, bonds, currencies, etc.)

- A private asset to counter cashless and digitally trackable trends

- Physical and mobile store of value that cannot be hacked nor easily stolen

- Fortune which can be easily passed on to heirs and loved ones

- Defense from both slow and even overnight fiat currency devaluations

- A multi-millennial, inter-generational proven store of buying power

Gold bullion remains one of the only default proof assets available to investors today.

Unlike virtually all other asset classes, unencumbered gold bullion as well other physical precious metal bullion products, cannot be made worthless by the failure of counter-parties.

The value of gold is not by mere human folly. It is in fact more scientific and rational than any currency proxy ever dreamed up or invented.

Regardless of what the world’s future monetary system becomes, gold’s value will remain worthy. Worthwhile for adornment and exchange, for usage as a store of value, or in applications for high tech medicine and aerospace. Gold’s future preciousness, usage, and consumption are in essence guaranteed.

Often denied but covertly still, gold is the underlying bedrock and foundation of global finance. The world appears to be relearning why this remains so.

1 tonne of gold bullion = 32,150.7 troy ounces of gold bullion

In this gold fundamental section we will cover basic information on gold bullion supply and demand factors. How much is where in the world and why.

We will also elaborate on gold spot price discovery and how gold bullion prices function not only now, but also the recent past, and possibly in the future.

Gold Supply

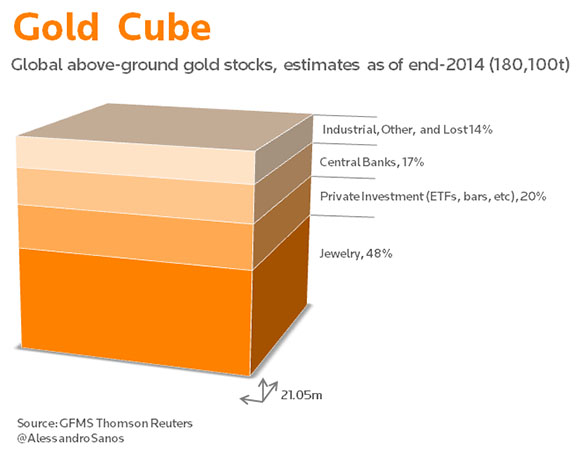

Estimates are that all the gold ever mined would fit inside a cube of 25 meters. Picture about 3 olympic sized pools full of gold bullion. Perhaps imagine 1/3rd of the Washington Monument filled with the world’s all time above ground gold supply.

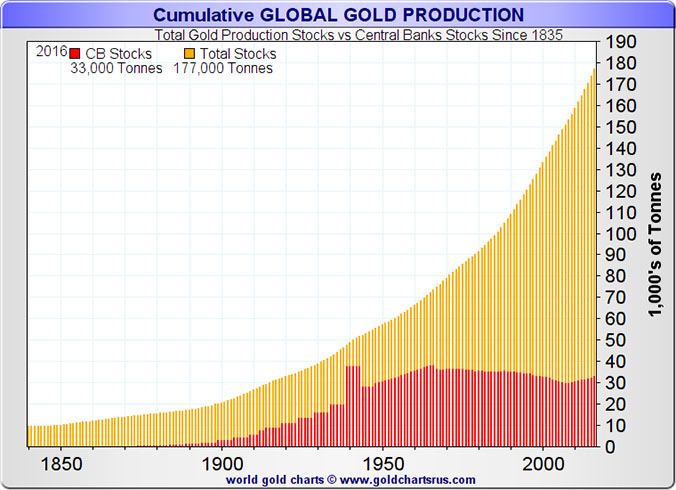

Although the gold market remains rather opaque in terms of who has exactly what amounts, experts and geologists generally estimate the all time above ground gold supply level stands at about 187,200 tonnes of gold ( or about 6 billion troy ounces ).

Above ground gold supplies grow at roughly 1.5% per year which coincidentally today is about the same percentage annual growth for the world’s population of human beings.

Mathematically there is about 0.79 oz or 24.5 grams of gold per human alive today.

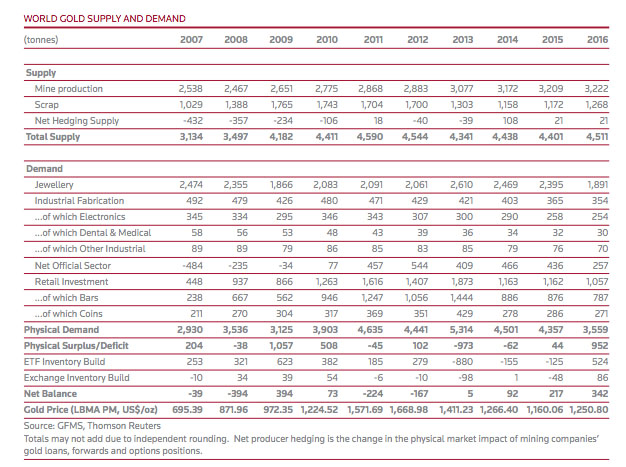

The annual gold supply is now hovering at about 4,000 tonnes a year (128 million troy ounces). These annual supply numbers can be misleading, as only about 70% is coming fresh from gold miner’s extractions with the remaining 30% of gold’s annual supply coming from recycled gold scraps.

Thus only about 100 million oz of new physical gold is available on a yearly basis.

Unlike industrial silver or other scarce industrial precious metal supplies, over 90% of the gold which exists above ground eventually again gets recovered in scrap recycling and refining, ultimately being put back into above ground gold inventories.

Pure gold is indestructible.

It cannot be destroyed by fire. It does not corrode, rust, or tarnish.

Scientists and astronomers now speculate that gold (and other precious metals) are formed in the rare case of neutron star collisions and star supernovas.

Gold is so fungible it can be broken down into nano-particles. Although rare, there are even some industrial gold applications which cause some gold to be thrown out, unrecovered by human beings.

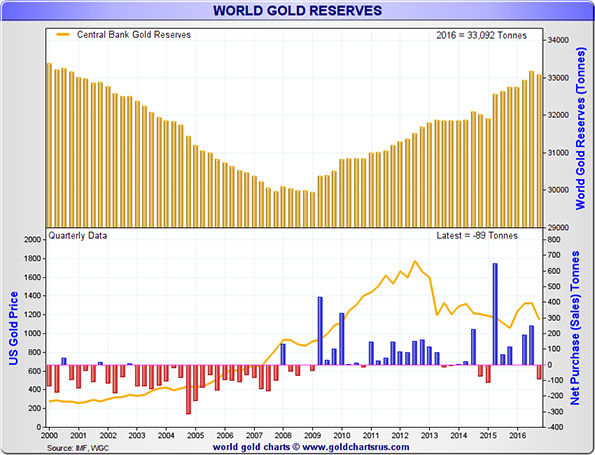

Nearly 1/5th of all the gold ever mined by mankind is currently being held and hoarded by governments and central banks alone. Nation states have owned and stored gold bullion for thousands of years, well before even the invention of fiat currencies themselves.

This will likely never change as all private and public currency proxies stemming from gold (and arguably silver too) always end up defunct and worthless given enough time.

Where is gold mined?

Gold is mined in various regions around the globe.

Today the largest gold mining nation is China producing about 15% of the world’s annual gold mine supply.

China consumes all of its annually mined gold domestically, it exports none of it.

As well China imports further gold bullion supplies via Hong Kong and Shanghai.

China also buys foreign gold mines, the eventual majority output of those foreign mines end up within her borders too.

constitutes 18.5% of gold ever mined )

Industry data shows China (as well as many other eastern nations) have been actively building their gold reserves acquiring bullion from the west with the aim of having more influence in the world’s next international monetary system design and functionality.

China expressed this to its citizenry dating as far back as 2009 (see part #3).

Some go as far to suggest there is an ongoing US / China policy allowing China to acquire her growing gold supply at depressed prices. This alleged tacit agreement allows China to hedge her rather large US dollar surpluses formerly held heavily in US bonds and US dollar denominated debt instruments mostly accumulated from large product manufacturing outflows from the 1990's onward. In short, “Made in China” needs a gold hedge.

Anecdotally there are also first hand disclosures in the public record with swiss gold refinery directors (the largest gold refinery region in the world) confirming ongoing difficulties sourcing enough physical gold to meet current eastern gold bullion demand.

Sure there may appear to be infinite gold derivatives to go around. But finding enough physical gold bullion to help actually meet growing physical demand has not been easy.

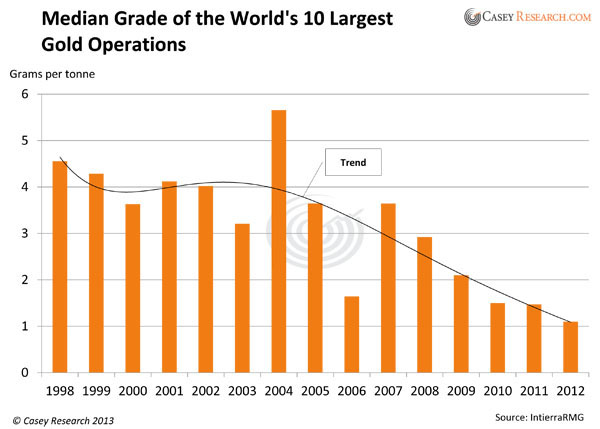

As well according to gold mine researchers, gold grams recovered per tonne of Earth by the world’s largest gold mining operations have significantly fallen this 21st Century. In other words, it has become more difficult and costly to profitably yield enough gold to meet ongoing demands.

Will the future supply of physical gold be enough to meet world demand in the coming years and decades?

Will gold’s future fiat currency prices and purchasing power value have to aggressively rise to offset diminishing bullion supplies and gold gram per tonne yield trends?

“Production (of gold) is declining and this is going to put an enormous amount of pressure on prices down the road. If you look back to the 1970s, 1980s and 1990s, in every one of those decades the industry found at least one 50+ million ounce gold deposit, at least ten 30+ million ounce deposits and countless 5 to 10 million ounce deposits. But if you look at the last 15 years, we found no 50 million ounce deposit, no 30 million ounce deposit and only very few 15 million ounce deposits. So where are those great big deposits we found in the past? How are they going to be replaced? We don’t know. We do not have those ore bodies in sight.

What the (gold mining) industry has not done anywhere near enough is to put money back into exploration. They have not put anywhere near enough money into research and development, particularly for new technologies with respect to exploration and processing. The way our industry works is it takes around 7 years for a new mine to ramp up and then come to production. So it doesn’t really matter what the gold price will do in the next few years: Production is coming off and that means the upward pressure on the gold price could be very intense.”

- Pierre Lassonde, Chairman of Franco-Nevada, October 2017

Gold Demand

Gold Jewelry Demand

The current largest gold demand factor remains its use in jewelry and adornment accounting for about 50% of yearly demand.

Indian and Chinese gold jewelry buyers make up the largest block of gold jewelry demand accounting for over ½ the world’s yearly gold jewelry demand. It is estimated that amongst 2 billion Chinese and Indians citizens there is some $2 trillion in physical gold held, about 1/4th of all the gold ever mined.

In the eastern world often gold jewelry is seen as a respected vehicle for gold ownership and savings. Giving gold jewelry gifts in wedding dowries is still a common practice in both Indian and China.

Just take a quick 360° virtual tour of a typical Indian gold jewelry and bullion store front.

Now simply look how both China and India’s fiat currencies have performed versus gold over the past 40 odd years or so.

Physical gold jewelry buying in the east remains consistent with traditions dating back many thousands of years there.

Unlike ridiculous gold jewelry prices in the west. Eastern gold jewelry is often bought at prices about 10% above spot price, the jewelry is made with 22k to 24k gold often with gorgeous intricate designs.

In the east, high purity gold jewelry is perceived as a store of dependable value that enables people to hold on to an earned surplus of savings generated throughout both their and perhaps their forefathers’ lifetimes.

It is rather reasonable to expect many of these 2.6 billion people to continue buying physical gold in high volumes. Especially as their middle classes further develop and accumulate wealth in this 21st Century.

Government Gold Demand

Nearly 1 of every 5 ounces of gold ever mined is currently being held by government central banks. Since the 2008 financial crisis, total central bank and government gold bullion buying has become a dependable positive factor driving higher gold demand.

As reflected in the prior Silk Road gold chart, a growing and large portion of modern-day physical gold demand is coming from eastern nation states (e.g. India, China, Turkey, Russia, etc.).

Recent Russian central bank commentary as well as other reports indicate most of the largest gold bullion buying and mining nations (BRICS) are now developing their own single gold bullion trading systems (bypassing London and Switzerland, the two largest western physical gold hubs). Price discovery power is likely to follow from west to east.

Private Gold Investment Demand

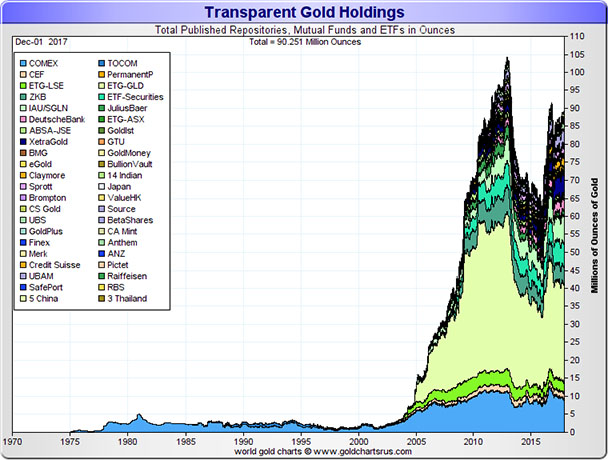

Especially since the aftermath of the 2008 financial crisis, physical gold has increasingly been demanded from both individual investors and government central banks.

Approximately 40% of yearly demand comes from these two segments alone.

Although often discussed in the mainstream financial press as a method to track gold demand, the reality is that all total transparent gold funds, ETFs, and futures contract exchange warehouses only account for about 1 in 67 oz of gold above ground.

Short term flows of less than 1.5% of all the gold ever mined, tells incomplete stories.

Gold bashing headlines who cite ETF flows are common in mainstream financial media as bullion owned outright is inherently an anti-Wall Street product. Perspective always requires remembering 2.6 billion Chindians, eastern central bank gold buying, the increasing strong hands who continue to acquire and hold gold bullion physically.

Industrial Gold Demand

Gold’s final demand segment driver comes through a mix of cutting edge aerospace, dentistry, medicinal, and industrial applications ( just shy of 10% of annual demand).

By its natural characteristics gold is resistant to corrosion, virtually impossible to destroy, while also offering superb malleability, conductivity, and biocompatibility (non toxic to human beings). Nano-gold particles also have increasingly promising applications in the fight against illness and cancer.

Gold is so soft it can be hammered into leaf sheets so thin and inexpensive that gold can be used as decorative wall paper or eaten in extravagant food dishes. A single troy ounce of gold can drawn into a wire so fine that it could stretch up to 50 miles in length.

The precious metals impressive conductivity and resistance to corrosion also make it the material of choice for high-end electronics and smartphone manufacturing.

Increasingly gold is also being used within many high-tech applications to help diminish harmful automotive emissions, in solar fuel cell production, within cutting edge space industry telescopes, the internet’s backbone wiring, and to protect astronauts from harmful space radiation.

The number of new patents now in existence related to gold nanotechnology suggests many new scientific applications using nano-gold will be coming to market in the decades to come.

With all the growing and varying uses for gold (e.g. in medicine, as jewelry, in technology, or held as a long term store of value), different sectors of physical gold market demand shall rise and fall in prominence throughout future economic cycles.

Yet gold demand has always had a self-balancing nature which has afforded the precious metal a historically consistent sustained base level of value.

Macro-economic forces at play today provide physical gold bullion the potential to substantially increase its value versus other asset classes in the years to come.

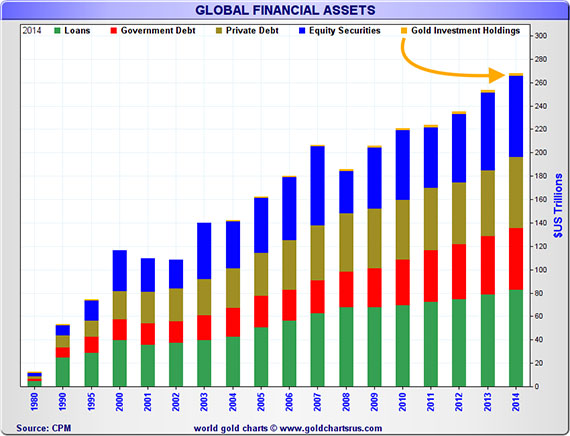

CHART: Gold as a Percentage of Global Financial Assets

Contrarian investors note where gold values currently stand as the world is reaching unprecedented price levels for both public and private debts, loans, and equity valuations. See 1980 to 2014 investment values. How much further can this continue?

Even the head of the Chicago Mercantile Exchange (CME) CEO and Chairman now states gold ‘should be’ 4Xs it's summer 2017 price.

I myself remain convinced that better times and higher valuations are ahead for gold.

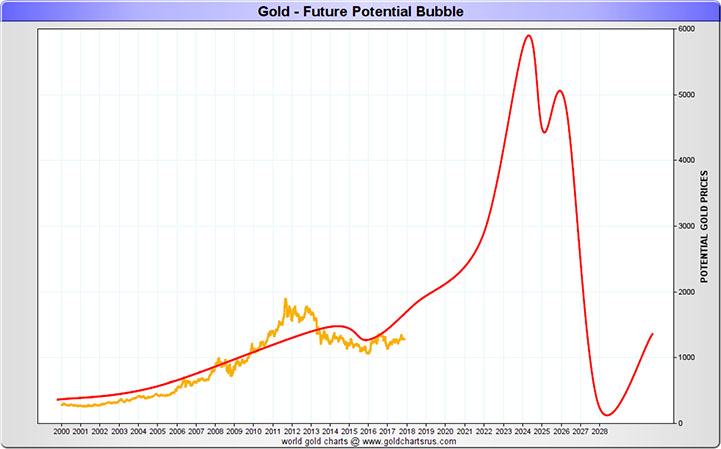

Given more than the last 3 decades of rampant financialization and fiat currency creation, gold’s anemic overall growth in value compared to credit and modern monetary aggregates make this (albeit somewhat slow to respond) physical precious metal poised for another potential prica mania to come.

How Gold Price is Determined (Gold Price Discovery)

Commodities like gold (as well as silver, crude oil, natural gas, palladium, platinum, wheat, coffee, cotton, and others) have standardized forward contracts traded on their fluctuating values. Also call futures contracts, they are listed on various futures exchanges throughout the world.

There are many futures exchange market acronyms you may have come across before, names like the NYMEX, CME Group, CBOT, SGE, COMEX, and more. These various futures exchanges are purportedly regulated by their national governmental (or semi-governmental) regulatory agencies.

Formal futures contract markets have been active for many millennia (dating as far back as The Code of Hammurabi).

The original intention of futures contracts was to give the producers of commodities (e.g. gold miners) and end users (e.g. gold refiners or bullion dealers), and commodity price speculators (those who simply trade on futures exchanges for short term gains) ways to respectively manage their price risk, buy and potentially take actual delivery of the real world goods, or simply to make bets on a commodity’s price movement up or down in the near future.

A commodity futures price is based on the ongoing price discovery for optional future delivery of that particular commodity (most often settled in cash, sometimes futures contracts are actually settled in the real world tangible good based on the stated contract’s explicit quantity).

Gold Spot Price – (n) the current notional price of 1 troy ounce of gold available for immediate delivery before being minted into a bullion product (e.g. bar, round, or coin).

The spot price of gold is actively determined by a commodity’s most highly traded futures contract at the time. The most traded futures contract can be the current month or it might be two or more months into the future.

Today the gold spot price is a combined indexing using many of the world futures market prices. But based on trading volumes, the gold spot price is currently mostly influenced by the highly fractionally reserved COMEX and London Gold Market.

As back-asswards as it may sound, the price of gold today is mostly found via selling and buying of virtual contracts representing the underlying potentially deliverable physical precious metal.

The positive news for physical gold bullion buyers is that the future price discovery for gold appears to be moving back towards physical reality (see China’s Shanghai Gold Exchange with 100% physical delivery required).

At present the parties who currently mostly influence today’s gold spot price (e.g. 6 commercial bullion banks specifically) are for the most part not actually exchanging physical gold, but instead trading derivative contracts (in their own account or for other clients) to highly influence what the real world’s physical gold price is and may be in the near term.

Many gold experts, continue to allege and point out that commercial banks aggressively own the short side on COMEX futures exchanges, to profit trading incited short term price swings, but also to ultimately stay solvent themselves. It is in the interest of many central banks and their commercial bank partners to help suppress gold and other commodity values. Allowing the opposite in extreme fashion could render them insolvent and powerless.

Other than the Shanghai Gold Exchange (SGE), all other gold futures markets are highly leveraged fractionally reserved gold exchanges. The vast majority of gold futures exchanges trade many multiples of representative gold ounces via gold futures contracts with only a very small percentage of actual gold bullion physically sitting in warehouses, and ultimately delivered upon in the real world.

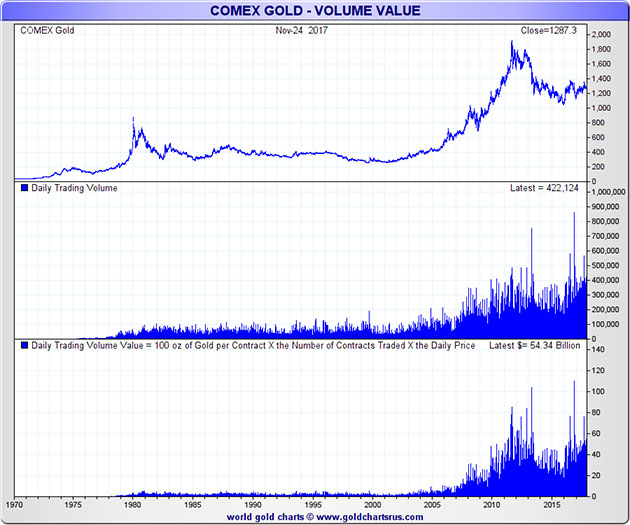

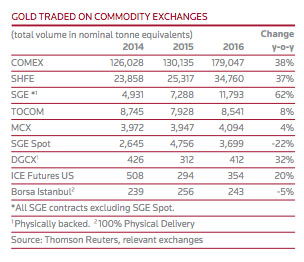

In the year 2015, the world’s gold futures exchanges traded gold futures contracts representing over 8 times more gold than humans have ever mined throughout history (1,539,690 representative tonnes traded in 2015 vs 187,200 tonnes mined all time to date). In 2014, Bloomberg estimated the gold derivative market totaled $18 USD trillion in notional value.

In reality, far less than 1% of traded gold futures contracts (excluding China’s SGE) are settled in actual physical delivery of gold bullion. Based on the 2015 statistics, nearly 350 times more gold futures contracts were traded that year than actual physical gold supplied to the world’s gold market.

To summarize the current ‘Gold Price Discovery’ situation, understand the following.

The price of gold is mostly influenced by short term price speculators trading futures contracts on western exchanges today. Record COMEX gold futures trading volumes prove that statement as there has not been a substantial increase in gold mine hedging worldwide (actually headlines suggest there has likely been an overall decrease in forward gold mine hedging over the last decade).

Political and economic events do have influence over the short term price of gold, it is often where the largest market interventions occur. With scrutinization, it is dubious and naive to believe that what we are seeing today resembles a real free market price for gold (and other precious metals for that matter).

Yet when a large enough percentage of the world starts demanding physical delivery of their gold bullion (or other precious metals), the current highly leveraged fractionally reserved futures contract markets will be forced to adapt to a situation where deliverable physical gold bullion again indeed drives the price for physical gold.

COMEX futures contract ‘price circuit breakers’ have been recently readied (implemented in late 2015) and are now awaiting what is possibly going to be an unorderly future for gold and other precious metal futures contract prices.

Various macroeconomic forces appear to be converging, likely ensuring this 21st Century gold bull market has yet to see its highest price peaks (in all fiat currencies currently issued).

Gold Bullion Prices vs Gold Spot Prices

Almost all competent online bullion dealers host live gold spot price quotations on their website typically based in their local currency (e.g. US dollars, Canadian dollars, euros, etc.).

Gold bullion buying and selling is an incredibly competitive industry in the USA and in most industrialized nation states. Typically with United States online gold bullion dealers, the gold bullion products available to purchase and take delivery of are priced per troy ounce of gold.

It is often possible to acquire gold bullion at mere basis points or perhaps only a few percentage points above the fluctuating gold spot price. The additional price to acquire investment grade gold bullion product is due to the costs associated with refining, manufacturing, minting, marketing, hedging, and warehousing the respective gold bullion products on sale.

In contract, when selling gold bullion to online gold bullion dealers, gold bullion products will typically yield a sell or bid price at or just below the fluctuating gold spot price (depending upon the product type and mint hallmark).

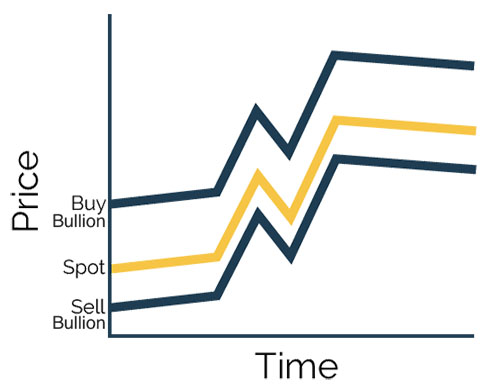

How Gold Bullion Prices Generally Operate in Calm Markets

In calm market periods, investment grade gold bullion product prices hover slightly over the fluctuating gold spot price. In other words, if gold’s spot price is $1,300 oz, most physical gold bullion products will be priced slightly above $1,300 per troy ounce of gold bullion. Variances during calm market conditions range as low as mere basis points above the gold spot price for large gold bullion bars to a few percentage points above gold’s spot price for gold coins guaranteed by governments.

When outsized gold bullion market demand hits (like it did during the 2008 Financial Crisis), gold bullion prices for products available for immediate delivery climb higher (often on both the sell and buy side) to levels which both can hover above the world’s fluctuating gold spot prices.

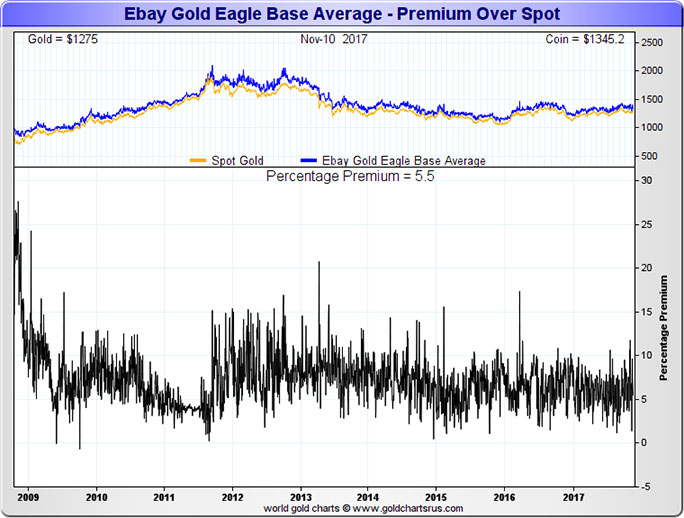

For example, take a look at how the world’s most popular gold bullion coin was priced as high as +25% over the fluctuating gold spot price in the fall of 2008.

25% above the gold spot price in the fall of 2008

In summation:

Gold’s spot price relation to deliverable physical gold bullion currently functions like so:

- Futures traders buy or sell gold futures contracts on worldwide futures exchanges, this trading’s ‘price discovery’ determines fluctuations in gold spot prices in various fiat currencies.

- Miners of gold extract and typically sell mixed gold ore and doré bars to gold bullion refiners at prices just below the fluctuating gold spot price.

- Refiners of gold melt and purify the gold ore into .999+ fine bullion or grain then sell these products to governments, mints, or gold bullion dealers at or just above gold’s spot price.

Both government and private mints strike gold bullion coins or manufacture gold bullion bars, selling them to gold dealers or the public at large at prices typically above the gold spot price.

Retail and wholesale bullion dealers like us at SDBullion.com produce, procure, and sell gold bullion products for discreet fully insured delivery to door or to professional fully insured segregated non-bank storage facilities at prices just over gold’s fluctuating spot price.

When one learns how fractionally reserved futures markets currently operate and derive the various fluctuating gold spot prices, they often simply choose to bypass electronic gold derivatives and simply elect to buy and take physical delivery of their gold bullion.

In just 2 minutes time, you can hear a highly successful hedge fund manager explain exactly why in 2009, serving as a fiduciary at UTIMCO, he and the other board members chose to acquire physical bullion over virtual derivatives or futures contracts (combination of being both less costly and arguably much safer).

By acquiring gold bullion physically and owning it directly, you can potentially take advantage of future scenarios when gold bullion premiums spike over fluctuating gold spot prices whilst simultaneously reducing the myriad counter party risks associated with virtual gold proxies trading during limited market hours like futures contracts, ETFs, mutual funds, mining shares etc.

More investors and central banks across the world want to buy and hold gold bullion directly, owning it fully unencumbered, to help insure the fact that they indeed own it outright for the long term.