How the Bullion Market Works

From star supernovas to your hidden bullion stacks, learn how physical precious metals got from way over yonder in the universe to us here on Earth.

To start, let us put our nerd glasses on, one second.

Ok, where shall we begin?

Alchemists throughout history have tried and failed to produce precious metals from base metals or other more ubiquitous Earth elements. In its place, the Chinese figured out the fiat currency trick about 1,000 years ago.

The ability to simply create purchasing power from virtually no collateral appears to only be attainable for limited timespans by various cryptographers, gun toting governments, and their academic scholar backed central banking systems.

Today we humans have managed to build an over $8 billion USD atom collider which can produce about 1 gram of gold, but only in the same amount of time it took the entire universe to form itself, in totality.

According to modern science, the origin of all physical precious metal bullion begins with the most violent moments known in the universe. God's money indeed comes stars we see night or day having come to their end.

Thus physical precious metals are indeed precious, finite, and very limited in supply.

In star supernova, heavy precious metals are formed and eventually traverse across space on asteroids until ultimately forming and or colliding with planets, infusing their crust with various precious metals like gold, platinum, palladium, or silver.

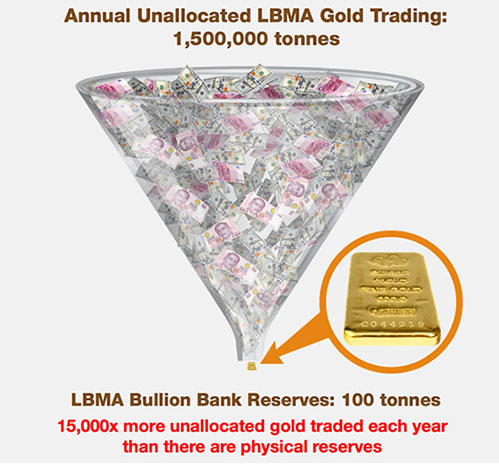

Regardless of all the outsized unallocated precious metal derivatives precious used to establish ‘price tracking’ proxies in today, any real physical precious metals of quantity were only produced either through colliding neutron stars and or various single star supernovae.

Of course many may think they trade precious metals using derivative contracts, yet in reality most precious metal price proxies merely trade digits or back and forth book entries.

How does gold, platinum, palladium, or silver bullion form?

The following supply chain illustrates bullion from its complete origin to long term bullion holder stashes.

Bullion's Supply Chain

Star supernovas produce precious metal elements

↓

Precious metal-laced asteroids crossed the universe, formed and collided with Earth

↓

We humans mine Precious Metals + Recover Precious Metal Scrap

↓

Precious Metal Refiners purify these precious elements ( gold, platinum, palladium, silver )

↓

Bullion Mints create bullion products ( bars, rounds, coins )

↓

Bullion Dealers trade bullion products ( often online then nondescriptly mailed fully insured to door)

↕

Customers buy, own, sell, trade, etc.

Bullion and physical precious metals from inception to owner is truly a miraculous journey of the universe's inception to the economy of modern mankind.

If executed with best practices in mind (environmentally sustainable ore extraction, low premium / high volume sales where everyone wins, etc.), we would argue sustainable bullion trade practices do way less harm to the world than limitless fiat currency expansion has.

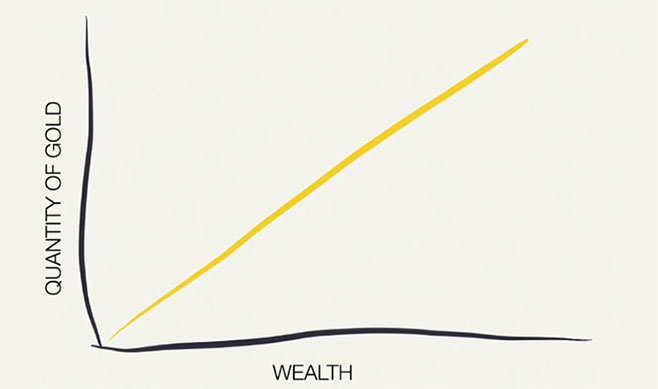

Precious metal monetary systems certainly helped our forefathers and the masses better maintain wealth over the long term than all other fiat currencies have.

As for those bullion customers who are looking to buy, own, sell, and trade in this 21st Century Gold Rush, the following best practice sections are specifically written for you and your well being.

Yes we are 'Captain Obvious'… yet we still need to warn you.

Most bullion and coin dealers have good business practices.

But unfortunately there is also a surprising level of bad actors both within the gold industry (and those even pretending to be) who use various tactics to take advantage of unsuspecting individual investors.

In all seriousness, the simultaneous growth of the internet has helped expose poor and frankly outright embarrassing business practices still active within our industry.

Yet everyday many unknowing (would-be bullion buying individuals), are taken advantage of in various ways (e.g. alleged bait and switch scams, even outright Chinese counterfeits).

In the following section, we will discuss in detail some of the poor alleged business practices we are alluding to. And most importantly how to potentially identify them ahead of time and completely avoid them with proper due diligence.

Learn how to both identify and steer clear of potential gold dealer bankruptcies, frauds, and scams.